Graduating from College without a Financial Strategy

When I entered college at Quinnipiac University in 2008, I made a goal that by the time I graduated I would be able to fully support myself. My parents had shelled out thousands of dollars to support my growth throughout the first 18 years of my life and I was determined to lessen their burden once I graduated.

As I approached the end of my college career, I began to think more about the goal that I had set four short years ago. I had a paying job with the eCommerce business that I had helped to start and I was going to be paid to return to South Africa as the Country Associate for June through August.

While I had a steady income coming into my bank account, I had no strategy to manage my spending once I received the money every two weeks. My lack of strategy led to me spending an exorbitant amount of money in my final semester of college…money that could have been saved for the future.

As we all know, hindsight is 20-20, but there is no means of sulking on the mistakes that you made. It’s much more important to learn from your mistakes, understand how you can do better, and make change. So, I did just that.

Jim Cramer’s Advice for Managing your Finances

After realizing that I needed a strategy to manage my spending, I did what I always do when I need to learn something new: I read. As a recommendation from a good friend, I picked up “Jim Cramer’s Stay Mad for Life: Get Rich, Stay Rich (Make Your Kids Even Richer)” to learn more about saving, investing, and the biggest mistakes that people make with their money. I read the book slowly over the next few months taking notes on each chapter and understanding where I could improve.

The book gave me an amazing introduction to the purpose of individual retirement accounts (IRAs), sound investment strategies, and how to avoid the pitfalls of poor money management. I highly recommend the book to anyone looking for an introduction to personal finances. It is a resource that I continue to return to as I grow today.

Finding my Break Even Point

While Jim Cramer’s book gave me a better overview of managing my personal finances, the most important activity that I completed at the end of my senior year was a personal budget focused on my break even point. Knowing that I wanted to afford all of my living and luxury expenses, I asked myself the question,

“What is the minimum that I need to make each month to live the life that I desire?”

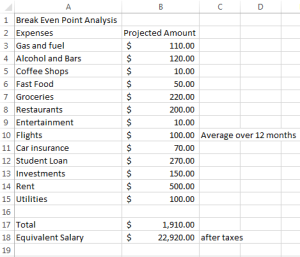

As a soon-to-be college graduate, I wasn’t seeking the world. I wanted to be able to afford my rent, food, going out to the bars, car insurance, phone bills, utilities, and start saving. I opened a new Excel document and started to plot out the areas where I felt I spent the most money on a monthly basis and how much money I would spend on each.

Below is what I came up with in the Spring of 2012.

By completing a simple 30 minute activity, I was able to gain a stronger understanding of how much money I would need to earn each month to sustain the lifestyle I was interested in living.

We all have different break even points

Now, please remember that this is not the magic number for everyone. Each individual has different preferences in lifestyle that lead to different amounts spent each month. Be honest with yourself when budgeting and always overestimate to give yourself some wiggle room for unforeseen spending. Also, don’t leave out areas that you guiltily spend money on, i.e. shopping, eating out, home decor, etc.

A Two Tier Strategy to Managing your Financials

Fast forwarding to the present, my strategy for managing my financials has evolved and become much more organized. The Excel document has become more advanced, I have more accounts to manage, and the preferences for my lifestyle have been slightly altered.

To help those of you who are interested in making your financial management more strategic, I would like to introduce my latest strategy for achieving short and long term financial goals.

Step #1: Create a 1 Year Projection of your Financials

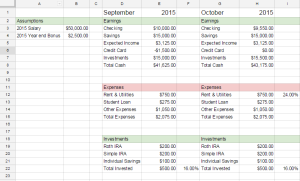

Around January of 2014, I decided that it was time to revamp my financial management to get a better hold of how I was spending the money that I was earning. I sat down and started to build upon my old Excel document to begin tracking my financial status at any given point in time and project my net earnings for a 1 year period.

I concluded that by seeing where my financial situation may be after a year, I could garner a better understanding of where I could cut spending in the short term to achieve long term goals.

Here is the document that I still use today to understand where my financial situation may end up in 1 year if all factors stay constant. I recommend reviewing the 1 year projection at least two times per month to track progress and remind yourself of your goals.

**Note that all numbers included in the screenshot are hypothetical for the purpose of the activity and do not reflect my actual financial situation.**

Let’s break it down so everyone can understand how they can use this template to project their 1 year financial situation. On the far left, there is a section titled “Assumptions.” In this section, I include variable factors that may change over time, i.e. salary and bonus. These assumptions are then properly linked to the “Expected Income” field in the 1 year chart.

If you direct your attention to Month 1, you will see the month split up into 3 sections: Earnings, Expenses, and Investments.

Earnings: all present information for bank accounts, credit cards, expected earnings, and total investments.

Expenses: details all expenses that I expect to incur during that month. I will explain where I get these numbers from in the next section.

Investments: highlights how I am contributing to my investment accounts and what it is as a percentage of my monthly earnings. As a general rule of thumb, it is smart to invest at least 20% of your monthly income if you are able to.

Interpreting the Template

The beauty of this template is that once you fill in the accurate information for the first month, the rest of the months are linked so the remaining months auto-fill. Keeping an eye on the “Checking” account over the 4 months included in the screenshot will show you how your financial situation may change for the better or worse based off of your assumptions and the expected earnings and expenses that you initially entered.

Financial Freedom

Knowing where your financial situation may head over the next year can grant you much more peace of mind when living your life. You’re not stressing about buying a plane ticket to go home for the holidays or splurging on an expensive dinner with your loved one because it has already been accounted for in your budget.

The more that you know about your financial spending habits, the better path you are on to live a life free of financial worries.

Step #2: Use a Method for Tracking Weekly Progress

The second aspect of my financial strategy is managing spending on a weekly basis according to a budget that I have created. In the past few years, I have tested multiple budgeting tools and have even created my own manual process. However, I have continued to return to Mint.com.

Mint.com is a website and mobile application where you can link all of your accounts, create budgets, categorize transactions, and set payment reminders. To complement my yearly projections, I have created and manage a monthly budget in Mint.

Here are a few screenshots of a hypothetical budget and how I use Mint.com the most. For more information on using Mint.com, keep an eye out for my How To Guide on Utilizing Mint.com for Budgeting.

Create and Manage your Monthly Budgets

Schedule Monthly Payment Reminders

Reviewing Mint.com

Each week – usually while laying in bed before I sleep – I simply open my Mint.com app and review my budgets.

I start by reviewing uncategorized items (transactions that were not categorized to a certain spending bucket by Mint) and assigning them to the appropriate budget.

Next, I recognize where I have already spent more than I wanted to. For areas where my spending is past my desired average per day, I make short term goals to avoid spending in those areas.

Last, I review the Overview section that provides you with a comprehensive snapshot of your financial situation taking all factors into account.

At the end of each month, I review my spending compared to my budget and I make small adjustments to be more accurate in the next month.

Take Control of your Personal Finances Today!

It’s never too late to get a better handle over your personal finances. Take the time this weekend to sit down and reflect upon your financial spending over the past 6 months. Are you happy with your decisions? Could you change certain habits to better align with your long term goals?

Article Comments

Aleshia Bemrose

March 1, 2016 5:55 amWould you be enthusiastic about exchanging links?

Connor Gillivan

March 13, 2016 10:45 pmHey Aleshia! Happy to discuss the opportunity. Please send your inquiry to connor@connorgillivan.com